Types of Property Suitable for Auction

Any property can be sold at auction, but some properties sell better at auction compared to a private treaty (estate agency) sale. This article explains what types of property are best suited to an auction sale.

For your peace of mind we are a member of The Property Ombudsman.

Call 0800 862 0206 for your FREE sale price estimate

What types of property are best suited to an auction sale?

Most types of property can be sold at auction, though some tend to perform better than others. In fact, certain properties achieve higher sale prices at auction than they would through an estate agent. For example, properties with potential for improvement or development often attract strong demand and benefit from the competitive bidding environment that an auction creates.

Updated by Mark Grantham on 16th February 2025

Ready for auction?

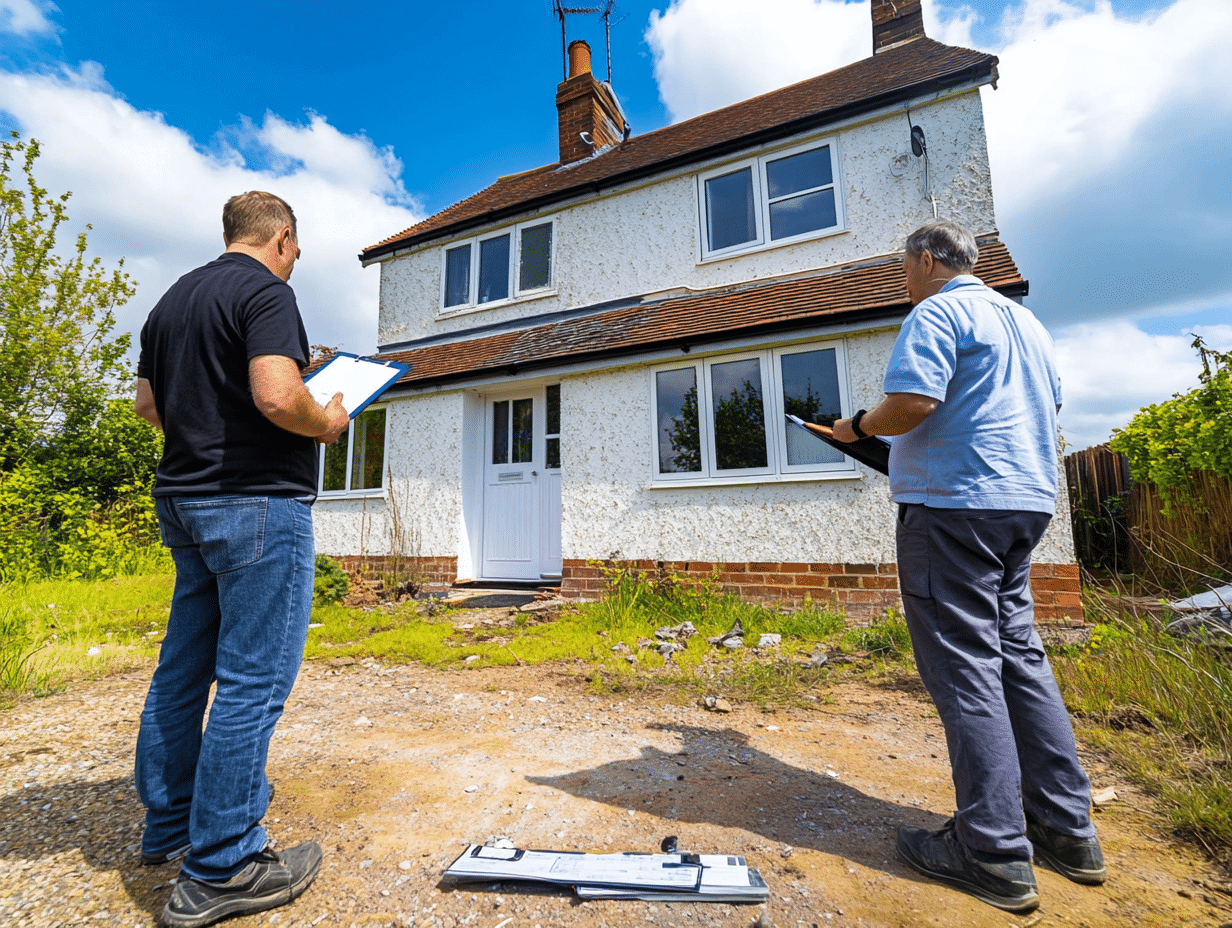

Request a free valuation and reserve price estimate for your property today. In some cases we may need a few more details about your property before providing a free and no-obligation auction sale estimate.

Non-standard construction properties typically have concrete walls or steel frames. Most mortgage lenders will have restrictions on financing non-standard constriction properties, so selling at auction to a cash buyer can be a good way to ensure the property is sold quickly, without having to wait on decisions from mortgage companies. When calculating a purchase price prospective buyers will take into consideration the cost of converting the property into a more standardised type of construction so that the a mortgage can be secured against the property.

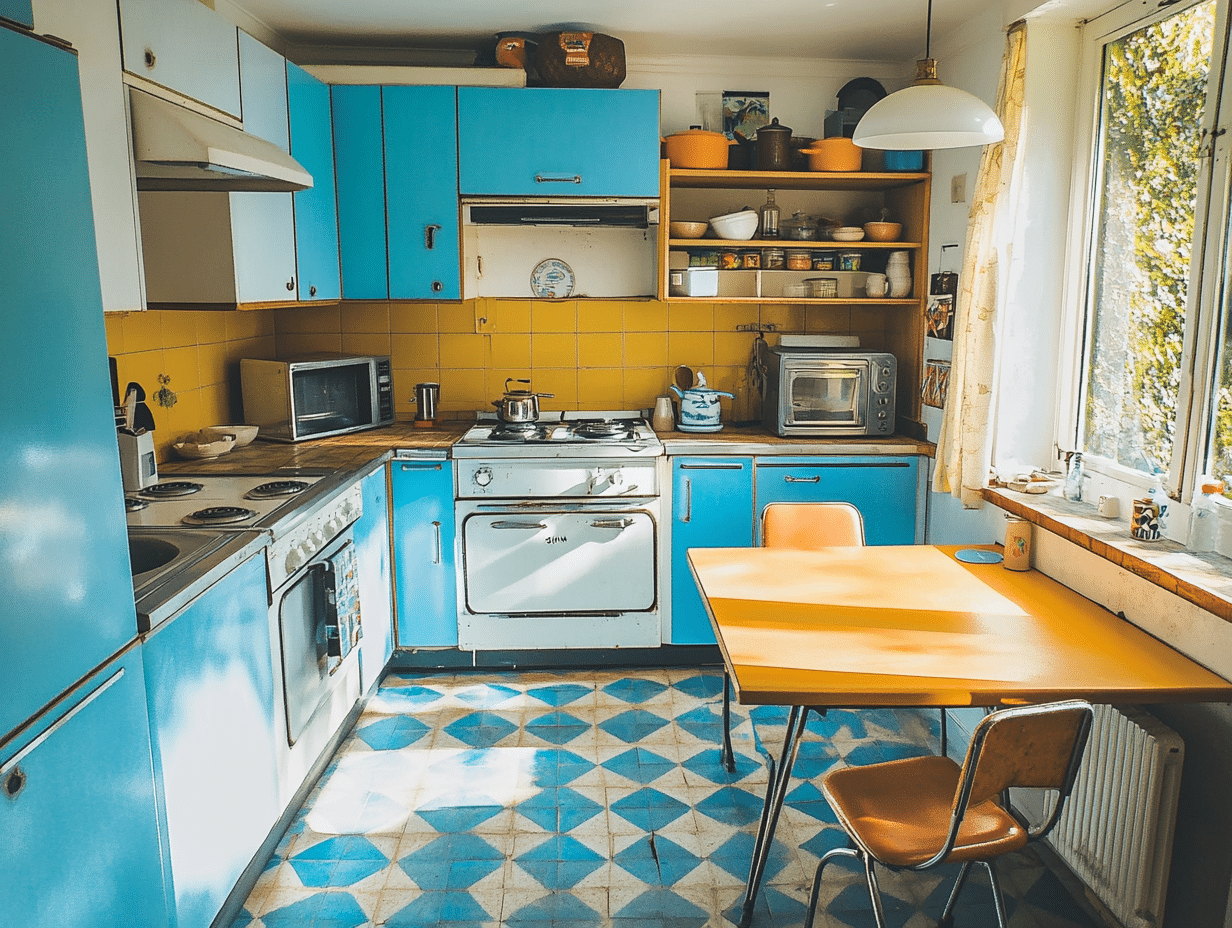

We’re often asked whether it’s a good idea to carry out improvement work to an unmodernised property, or to sell as is. Unless you’re a builder or have experience of refurbishment projects yourself, we recommend selling an unmodernised property as is, without spending any money on improvements.

Estate agents will typically give the same answer. It’s better to allow the buyer to carry out any improvements to their own taste. If you were fit new carpets before selling, it might be that the buyer prefers hard-wood floors, or maybe a different style of carpet.

Auction is often considered the best way to sell unmodernised houses and flats, especially if the property is in a good location. The rules of an auction sale mean the market decided on the value of the property; if one buyer estimates the cost of works to be £40,000 they’ll be out bid by other buyers who estimate the cost of work to be £10,000. Properties are sold to the top bidder, and there’s no opportunity for the buyer to haggle on price or back out of their purchase

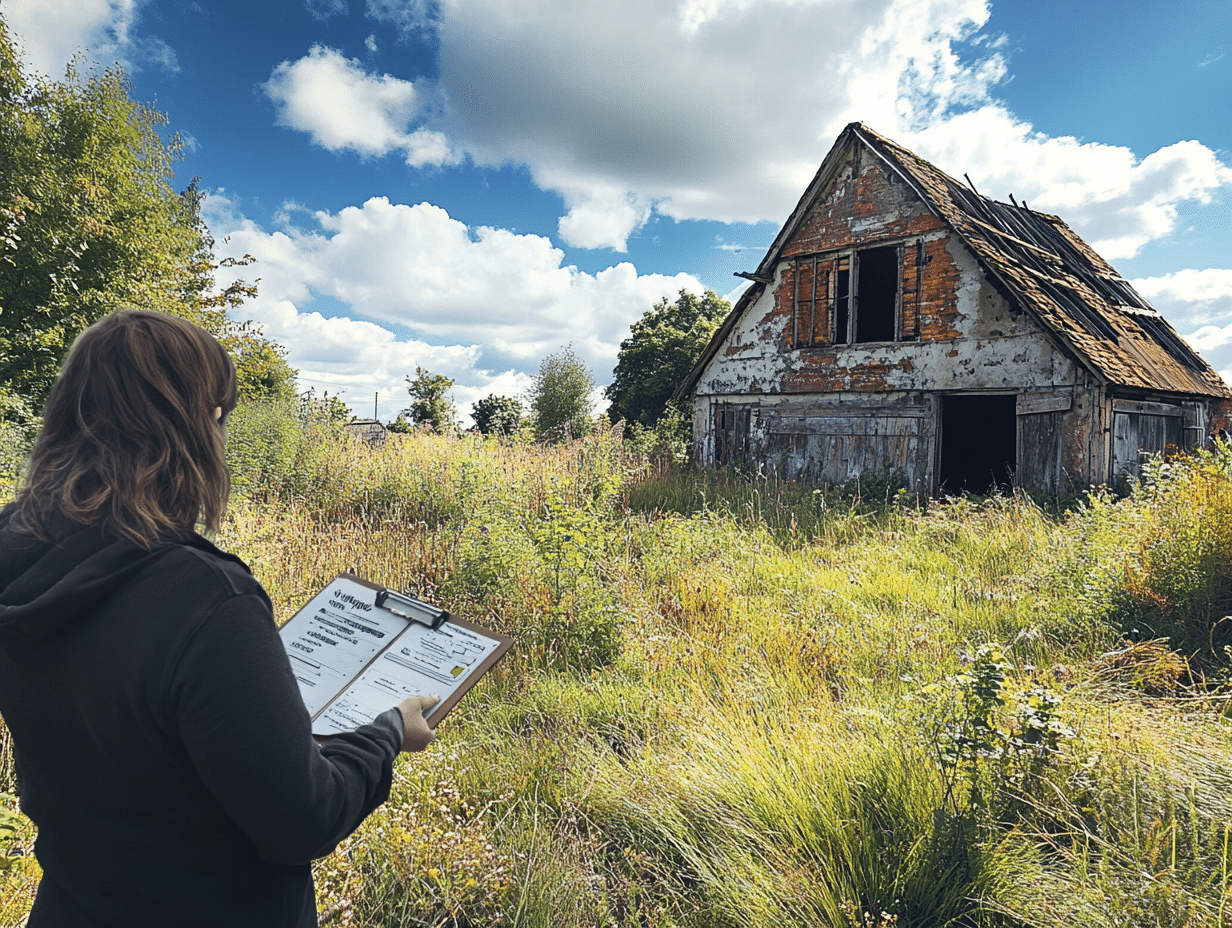

To some people, the idea of owning a run-down, dilapidated property is considered a burden and selling to the first person who’s prepared to “take the property off their hands” doesn’t seem like a bad idea. That’s understandable; there may be worries about the security of the property, the risk of squatters or concerns about the property falling into a further state of disrepair. Also the prospect of selling may seem complicated and uncertain, which adds to the motivation to sell as soon as possible, even if it means reducing the price. Sadly in these situations, it’s not uncommon for prospective buyers to take advantage of a seller’s vulnerability, sometimes in collusion with other parties – we’ve even heard stories about estate agents being involved.

Does condition matter?

Although auction is often viewed as the best option for selling properties in poor condition, it is equally suitable for houses and flats in good condition. The certainty and speed of an auction sale make it a compelling choice for well-maintained properties as well. More often than not, the decision to sell at auction is influenced by the seller’s circumstances rather than the property type.

If you’re selling a property in a poor state of repair whether it’s a flat needing cosmetic improvement, or even a fire damaged house in need of a complete re-build, it’s worth remembering that you’re selling an asset, not a liability. There will be people who see potential in the property and it’s important to open the property up to the widest possible audience.

For a property investor, whether they are experienced or first timers, seeing the classic signs of an avocado green toilet suite and worn-out swirl-patterned carpets, even an overgrown garden, are all signals for the potential to make a profit.

In terms of the price you can expect to achieve for a property in poor condition; experienced property investors will be in a position to renovate the property cost effectively, whilst first time DIY’ers will usually underestimate the cost of refurbishment, so end up paying more. In many cases a poor condition property will achieve a higher price at auction than an estate agents suggested asking price.

There are good reasons why mortgage companies (banks and building societies), local councils, housing groups and major corporate property investors “dispose” of poor condition properties at auction rather than with estate agents. The main reason being profit!

Selling a Condemned Property

If your property has been issued a condemnation order by the local council, you’ll likely be seeking the quickest and most efficient ways to sell. While this news can be unsettling, there are several practical solutions available for property owners facing this situation. Read our guide to selling a condemned property, including the option of selling by auction.

One of the benefits of selling a property by auction, is that it can be “sold as seen.” This makes auction the ideal way to sell hoarder properties – houses and flats full of old personal belongings. Although selling a hoarder’s house by any other method (through an estate agent or direct to a builder/developer) is possible, the process can be slow and prone to uncertainty, as there is nothing legally binding about the buyers offer. So offers are likely to be reduced or the sale fall though, perhaps if the buyer realises there’s more work involved to remove the hoard and carry out any remedial work. With auction the process is different; prospective buyers must carry out all their work (inspect the property, carry out legal enquiries etc) before they bid on auction day. And the highest bidders offer is legally binding; contracts are exchanged and the buyer cannot back out of their purchase or reduce their offer.

The likely buyer of a property with structural issues will be a builder or property developer who has the know-how to remedy the issue. They will be able to accurately calculate the cost of work and make a reasonable offer for the property. The benefit of selling a property with structural issues at auction is there will be an audience of builders/developers who are looking for projects and are prepared to compete for the property, knowing they will have a project on their hands within a month.

We’re often approached by owners of properties with Japanese Knotweed who believe they can quickly dispose of their property without disclosing the fact that the property has issues. Auction is a good way to sell properties with Japanese Knotweed, but sellers should always disclose any issues they are aware of.

It’s quite common to see short-lease flats being sold at auction. In a lot of cases properties (including the lease) have not been “maintained” and may only be suitable for cash buyers. This is typical if the property is inherited or being sold as a probate sale.

Rather than going through the process of extending a lease prior to sale, it’s most common to sell the property as-is, with a short lease.

Read our guide to selling a short lease flat by auction.

Selling a Flat with a Lost Lease

A lost or missing lease occurs when the original lease document, which outlines the terms of ownership for a leasehold flat, is unavailable. This document is essential as it defines the leaseholder’s rights and responsibilities, including crucial details such as lease duration, ground rent, and service charges. Without it, proving ownership or selling the flat can become considerably more complex.

While selling a flat a missing lease presents challenges, it is not impossible. If you find yourself in this situation, understanding your legal options and the necessary steps to resolve the issue is crucial for a smooth sale.

A recent survey by MoveWithUs estate agents found that one in ten properties coming to market are probate sales. These are properties that have to be sold and often represent the largest part of the estate. Probate properties are particularly suited to a sale at auction because they usually require some level of upgrading, whether that’s old fashioned décor or out-dated heating and electrics, where prospective buyers see scope for improvement, they see potential.

Selling a House with Equity Release

Selling a house with equity release can be a complex process, but it is certainly achievable. Whether you have a Lifetime Mortgage or a Home Reversion Plan, it’s essential to understand your options and obligations for a seamless sale. Learn more about selling a property with equity release – including the possibility of selling at auction – along with key legal considerations, tax implications, and alternative solutions.

There’s very high demand for these types of probate sales at auction, especially for those located in desirable areas. Prospective buyers often bid at prices very close to the value of comparable, but better condition properties on the same street, sometimes underestimating the time and cost involved in the work required to refurbish the property. The demand for these types of probate properties can be witnessed from the number of people who attend the viewings in the run up to the auction. It’s not unusual to see queues of twenty to thirty prospective buyers outside the property. The total number of people viewing the property can sometimes run into the hundreds. That in itself helps create the competitive bidding environment for the property on auction day. Read more about selling a probate property at auction.

Any property can be sold at auction. It’s not always about the type of property, but rather the seller’s circumstances that make auction a smart choice. Auction overcomes many of the inefficiencies of selling through an estate agent – particularly in England and Wales, where a buyer’s offer isn’t legally binding. Many sellers come to us after months or even years of trying to sell through an estate agent, only to experience multiple sales falling through. Frustrated by the uncertainty, they turn to auction as a more reliable and efficient alternative.

There have been countless examples of properties in excellent condition being successfully sold at auction, from multi-million-pound luxury homes to penthouse apartments overlooking the River Thames. While these types of properties may not traditionally be associated with auctions, they have repeatedly achieved strong results in the right auction environment.

Gone are the days when auctions were only suited to unmodernised properties. Today, modern auction methods cater to a wide range of sellers and property types. These newer auction formats differ significantly from the “Homes Under the Hammer” style auctions seen on TV. They function more like a highly efficient version of an estate agency sale but with crucial differences – longer market exposure to attract a broader audience of buyers, yet with the security of auction rules. Unlike an estate agency sale, where buyers can withdraw or renegotiate their offer at any stage, auction sales provide certainty – the buyer is committed, and the sale is secure.

However, vendors do not always have a choice, sometimes it’s not possible to sell with vacant possession. Some vendors have become “accidental landlords” with no planned exit route, but their personal circumstance might change, requiring them to sell their tenanted property quickly. Rather than asking their tenant to vacate the property at short notice they might feel more comfortable selling with the tenant in place. Or there might be legal reasons why the property has to be sold tenanted, due to the type of tenancy agreement that’s in place e.g. a sitting/regulated/life tenancy.

In some cases the tenant might be occupying the property illegally; whether that’s not paying rent as agreed, or breaking-in to squat at the property. It can be very costly and time consuming to evict stubborn tenants, especially if they “know their rights.” It’s often easier and more cost effective to sell the property with the tenant in place and let someone else deal with the problem – someone who knows how to taken on a problem tenant. Whilst an estate agent might be able to find this type of buyer, the eventual sale price might be a lot less than market value. Within reason it’s up to the investor to pay whatever price they feel comfortable with, they have the control. But at auction the property will find its price from the competitive bidding of the many prospective buyers who are interested in the property. This is an example of the benefit of the transparency when selling at auction.

Request a no-obligation offer estimate to find out more about selling your tenanted property at auction.

Both types of buyer attend auction and as with any property type, for a vacant commercial property where there is potential for improvement there will be a strong demand. But it’s the type 2 buyer, the investor, who sees auction as a trading place for tenanted commercial properties. There are specialist commercial property auctions that cater for commercial property investors e.g. the Allsop commercial property auction will sell around two hundred lots every other month. Prospective buyers are looking for a yield in excess of ten percent (lower in London) along with a tenant with a good covenant i.e. they would favour an established chain shop over a new independent shop.

Mixed use properties can be quite difficult to sell through the estate agent route because it’s quite a niche area. A mixed use property typically consists of a ground floor commercial property with residential upstairs, often under separate titles with separate tenants. Again, in most cases the buyer for these properties will be an investor interested in the longer term rental yield. But in some cases there may be scope for development e.g. extending into the roof space or converting the commercial part into residential.

Read more about selling a mixed-use property, and the pros and cons of selling by auction.

Banks, building societies and other mortgage lenders want to see that a property represents suitable security, one of the key requirements is that a property can be insured. So if you are selling a property that is unmortgageable due to not being insurable for some reason (e.g. there are structural issues) then it’s worth trying to find a specialist insurance company who can underwrite and insure your property, then you know when you sell the property is no longer unmortgageable, so you’re not limited to cash buyers. If you sell at auction you may be able to include a copy of the insurance schedule in the legal pack so prospective buyers know they too should be able to insure the property.

The list of properties that are considered unmortgageable is quite varied. One of the general rules is that a property must be fit for human habitation, so that obviously includes derelict and abandoned properties. But surprisingly it can be very difficult to obtain a mortgage if a property does not have cooking facilities or a refrigerator. Properties with very dated bathrooms are also considered unmortgageable, if they are unusable. These properties sometimes struggle to sell through an estate agent and are generally better off being sold at auction.

Selling a Flat with a Defective Lease

Selling a flat with a defective lease can be difficult, as buyers and lenders often avoid lease issues. Legal complications can delay or derail private treaty (estate agency) sales. Auctions offer a faster, more secure option, attracting cash buyers willing to take on lease defects, ensuring a quicker sale with minimal negotiations.

Read more about selling a flat with a defective lease by auction.

Selling a flat or property located above commercial premises in the UK can seem challenging, but it doesn’t have to be. These types of properties often come with unique complexities that require a more tailored approach for both buyers and sellers. If selling through an estate agent hasn’t worked, auctioning could be a highly effective alternative. Auctions attract cash buyers and investors who are less likely to be deterred by issues such as mortgage restrictions or lease complications. This method offers speed, certainty, and access to a focused audience, making it an excellent option. In this article, we explore the key considerations for selling a flat above commercial premises, address common challenges, and provide practical solutions to help you succeed.

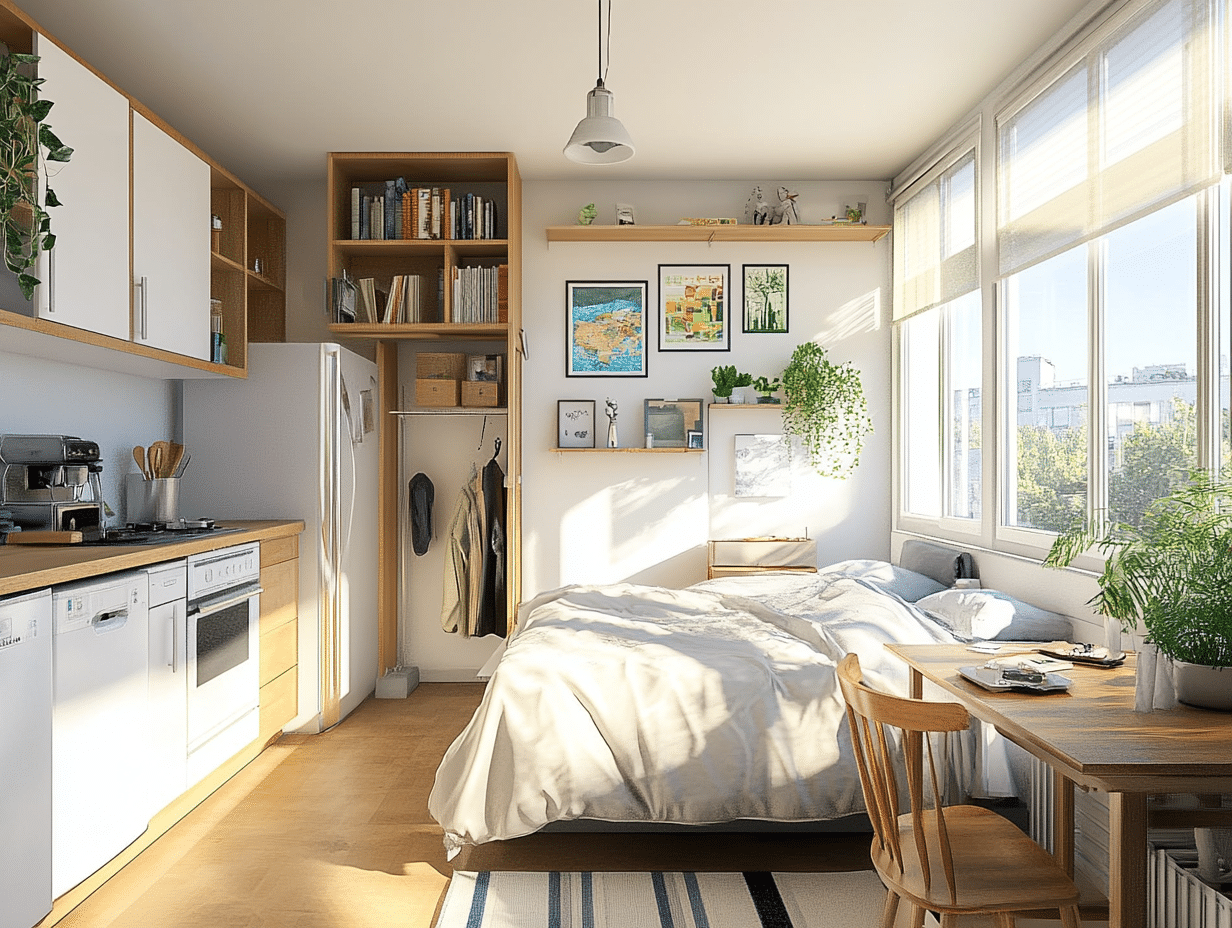

An unusual or unique property can be difficult to value because there are no directly comparable property sales to measure the value against. For example, a very small studio flat in a desirable area, which has been refurbished to a very high standard with smart, space saving utilities cannot accurately be valued on a price per square foot basis, so setting an asking price when selling through an estate agent can be difficult. Where there’s a strong demand for a unique property it can be a good idea to let the market determine its true value and this can be done by selling at auction.

Next steps…

Property types

ℹ Top auction tip

Need help choosing a property auctioneer? Please feel free to call us on 0800 862 0206 or send us an enquiry online.

🔍 Also see

💬 Auction talk

Contact us